“Getting Closer to the Customer” has been one of the top priorities for retailers in the last few years. What does that really look like? One of the requirements of getting closer to the customer is to ensure the right products are offered at the right time and at a price that is appealing and affordable to the target segments. Personalization of offers through digital channels is a way of doing that, however, there’s still the brick & mortar side of the business that needs processes and systems to manage the physical allocation of products to stores. For retailers covering diverse geography, different climates, and different demographics, the first step to localization is to identify stores that behave differently in terms of customer demand. Clustering is an approach that is widely used to identify and manage similarities and differences across a diverse set of stores.

What Is Store Clustering in Retail?

Store clustering is the process of splitting stores into segments so that product assortments, size allocations, and promotional offers can be localized as needed. Stores similar to each other are bundled together in a segment, while stores with different characteristics are assigned to different segments.

Store clusters are used in a number of different processes by apparel retailers including forecasting, assortment planning, size optimization, promotions planning, markdown optimization, and replenishment scheduling. Depending on the intended use, the way they are constructed can be different. One example of clustering is splitting them based on their climate biases into “hot” and “cold” stores. This enables localization of seasonal merchandise whereby hot stores receive more spring/summer assortment earlier in the year and cold stores get more outerwear assortments. As clustering methodologies get more sophisticated and complex so do the downstream decisions utilizing these clusters.

Store Clustering Techniques

Store Capacity Clustering

This approach is a very common practice and is used to make sure different-size stores are treated differently in order to manage product depth and breadth. It is often not very practical to make assortment breadth and depth decisions for each and every store, so retailers group stores into capacity segments using metrics such as:

- Net selling space (measured in sq. meter or sq. ft)

- Shelf capacity (measured in the number of display units such as shelves)

- Option capacity (represented as the number of distinct products each store is able to display at once)

- Unit capacity (represented as the number of stock each store is able to display at once)

The simplest and most common approach is to use total store capacity to do this type of clustering, however, in recent years, category-level capacities are also being used more often giving assortment planning another level of precision and complexity at the same type. While store-level capacities are manageable manually, category-level capacity management, clustering, and managing breadth and depth require more sophisticated systems.

Store Attribute Clustering

In an effort to get closer to the different customer needs and wants, retailers often use store attributes and some representation of customer demographics when creating store groups such as city stores, mall stores, and vacation stores, or use mall ratings such as A+, A, B, C… as a proxy to purchase power of the customers. Through data gathered in surveys and customer profiles in the CRM systems, retailers can create customer profiles in terms of income level, age group, education level, and cultural background. A single store attribute is not likely to really describe the needs and wants of the customers, therefore when using attributes, it is best to take a multi-dimensional approach and use profile-based clustering rather than a single descriptor or metric. This approach is often used when planning assortments of categories that do not have historical sales. Examples of metrics and attributes that can be used are:

- Average store traffic

- Location type (urban, suburban, touristic)

- Income profiles

- Cultural profiles (such as the ethnic makeup of the customer base)

- Mall type (A+, A, B, C..)

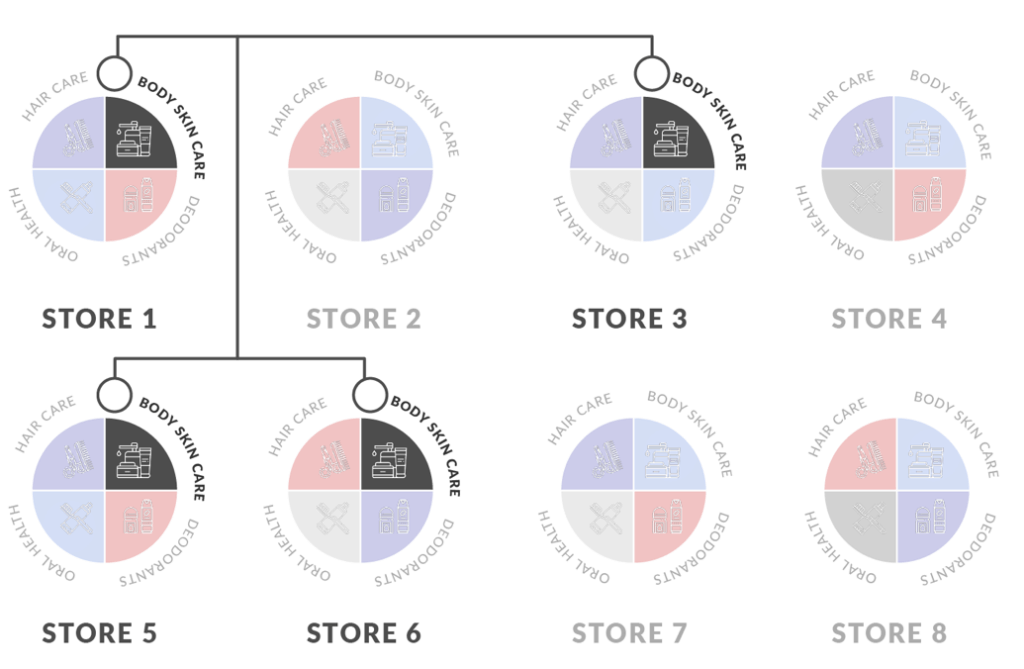

Category Sales Clustering

One of the approaches to clustering involves evaluating sales performance by category. This approach leads to a more precise understanding of variations in the level of demand across stores. This way, assortment breadth, and depth can be treated differently for each category. In this case, a store doesn’t necessarily end up in the “top” segment for all different product categories, because the store’s sales performance for each category is evaluated separately. A given store may be in the top segment for women’s wear and work dresses while being in the middle segment for activewear. This approach results in more store segments to be managed, and is not easy to support in manual spreadsheets, therefore, requires a more systems-based approach. Category-level segmentation is very common nowadays and has proven benefits in getting closer to the customers’ needs and wants. Common metrics used in this approach are:

- Weekly unit sales

- Weekly revenue

- Inventory turn (based on how fast stores turn the on-hand stock)

Productivity-based Clustering

Sometimes, it is helpful to understand how productive each store is in the way it moves the products. There are different ways productivity can be measured including:

- Revenue per square meter (or sq. foot)

- GM per square meter

- Unit sales per product (option, or SKU)

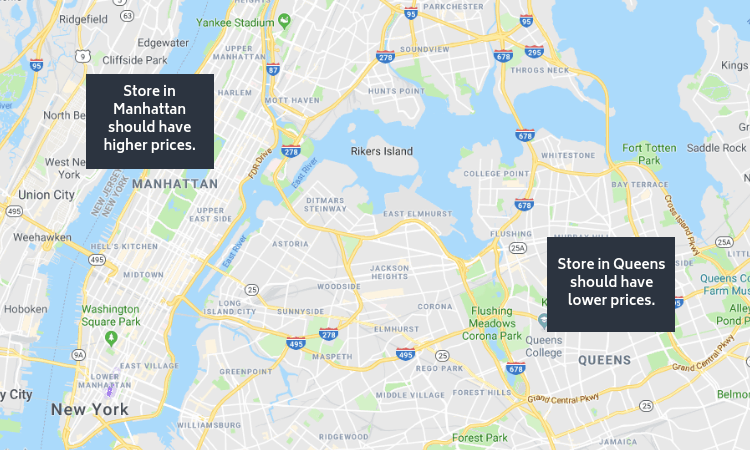

Price-based Clustering:

Price-based clusters are often used as an additional level of segmentation by retailers who offer a breadth of price points that target different customer segments. Price-based clusters can be constructed in a number of ways including:

- Average unit retail

- Price profile performance (based on the contribution of sales from different price segments such as high, medium, low, or based on the contribution of markdown sales and full price sales)

- Price elasticity (based on the change in demand in response to changes in price, often used in promotions planning and markdown optimization systems)

Multi-dimensional clustering

Now with advanced analytics, it is possible to group stores based on a combination of the above metrics and attributes. For instance, stores can be clustered simultaneously based on sales performance, capacity, and price performance for each category. Resulting clusters are then used in localized assortment planning decisions where breadth, depth, and price are considered when assigning products to the stores.

Clustering on its own can bring up a lot of insights about the variations in demand across the store based. As the level of sophistication and precision increases so does the complexity of application and management of these clusters. In order for advanced clustering methods to be effective, outputs of the clustering tools need to be integrated into downstream planning and decision-support systems.

A Powerful Platform for Clustering

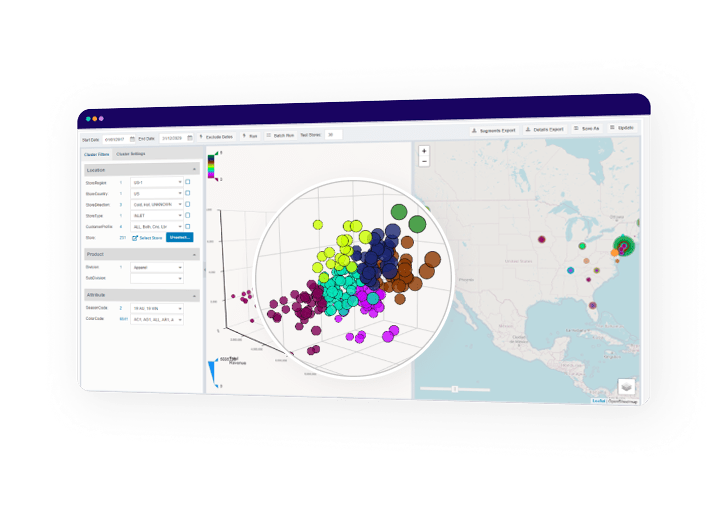

The Solvoyo Platform offers state-of-the-art clustering analytics for retail’s best practices:

- Selection of the most suitable attributes, feature set, and clustering method for each case

- Optimal-seeking methods, dealing successfully with the curse of dimensionality.

- Interactive what-if analysis of the results

- Advanced but intuitive visualization of the clusters

Solvoyo is a Gartner-recognized vendor that supports integration with many commercial 3rd-party ERP systems as well as homegrown systems. Our clustering capabilities support our other services that range from Demand and Supply Planning to Store Replenishment.